Our Business Model

Our business model is simple and transparent, focused on high margins, dividends and disciplined growth.

What We Do

We manage a portfolio of resource royalties, the cornerstone of which is our MAC royalty, with the intention to provide our investors with exposure to the value generated from mining, with a focus on shareholder returns. While providing attractive exposure to the upside, we aim to reduce exposure to the inherent risks associated with traditional mining investments such as increases in capital and operating costs.

Grow Value Responsibly

Our portfolio already has significant volume growth through the Mining Area C Royalty. We will benefit from BHP increasing production from this royalty area by 2.4x as the South Flank project expands by 80 million wet metric tonnes per annum (Mwmtpa) over the next three years (CY2016-20 average production rate was 58Mwmtpa).

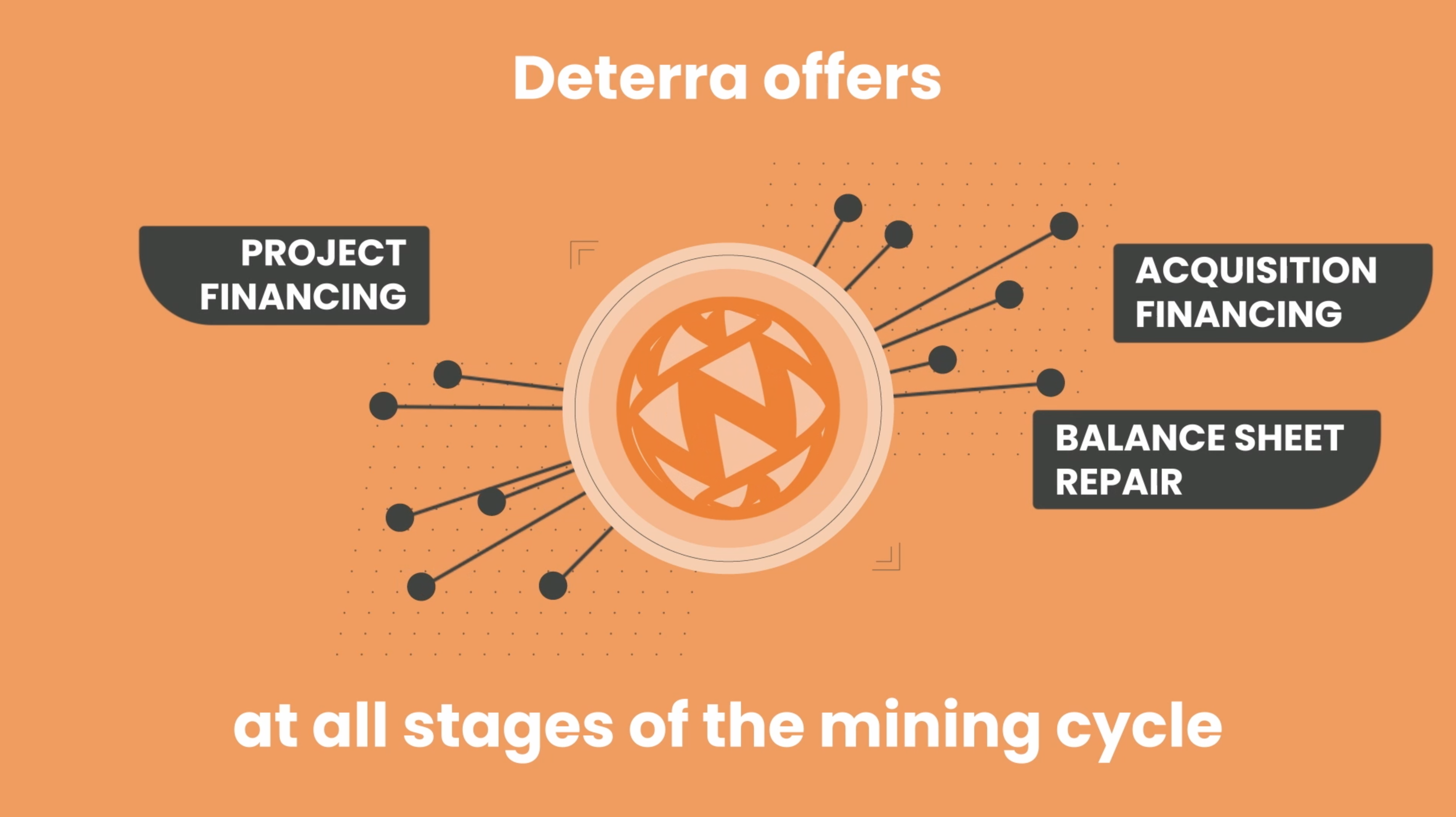

We aim to add to our royalty portfolio over time through the patient and disciplined acquisition of value accretive royalties. We will prioritise opportunities that give us a competitive advantage and are focused on areas where we think we can bring value to transactions which is likely to be in the bulks, base and battery metal space. Discipline is critical to the way we think about growth, and in terms of evaluating opportunities for us, that means maintaining a very clear focus on value and this is an ability to generate a return in excess of the acquisition’s cost of capital.